Low Float Stocks: What Are They, and How to Find Them?

There is a wide range of factors that affect equities prices. Internal factors like product updates, service expansion and structural changes affect anticipation, while external factors like overall market conditions and economic changes impact investors’ interest.

As a stock investor, investigating the number, value and outstanding shares is crucial to understanding prospective market movements and volatility.

Low float stocks provide higher rewards, but they are less common and come with various challenges, while highly supplied ones offer little gain value. So, what is stock float and how to determine a low float stock?

Key Takeaways

- Stock float refers to the number of available shares in public markets, excluding internal shareholders and company insiders.

- Low-float stocks mean there is a limited supply of shares in public marketplaces, making them highly volatile and speculative.

- Trading low floats offer high-risk/high-return opportunities, which can be executed using momentum, breakout or scalping investing strategies.

Understanding Float In Stock Trading

Floating stocks are shares available for public investors only, excluding internal team ownership.

When a company files for an initial public offering (IPO), it announces its capital stock and determines the number of issued shares to raise funds through internal and external investors.

Equities are distributed between secondary markets (private and public) and the company itself (treasury shares), while outstanding shares are those offered in trading markets, excluding treasury stock.

Stock float is the number of shares outstanding offered to public trading (individual and institutional investors). A company’s float is measured by a ratio compared to shares owned by internal investors, which determines the company’s control level over its stocks.

What is a Low-Float Stock?

When publicly available equities are less than privately held ones, they are called low-floats. It means that there are fewer “floating” shares that market participants can buy and sell on over-the-counter exchanges and brokerage firms.

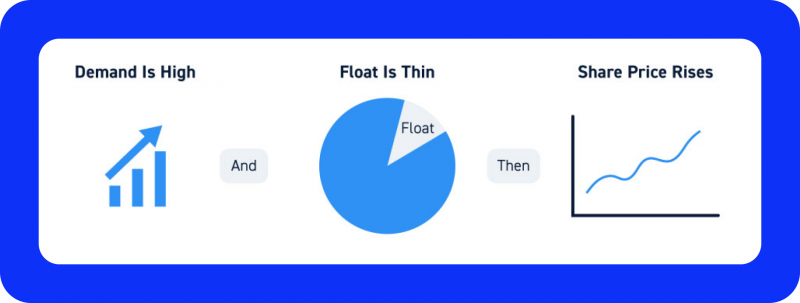

The number of the stock float depends on the organisation’s size, valuation, amount it wishes to raise, and public interest. Low float stocks offer more rewards because they are scarce, and as their demand increases during earning reports or sales, their value can increase significantly.

Is a Low Float Stock Good?

It is a high-risk, high-reward investment that can potentially provide generous income. However, if the stock market moves sideways and selling pressures prevail, prices can deteriorate rapidly.

Therefore, it is wise to have a combination of high-float and low-float shares to achieve portfolio balance.

Fast Fact

Tesla was a low-float stock company after its IPO in 2010. However, it quickly grew to medium and high float with massive R&D investments and striking market value.

High Float vs Low Float Stocks

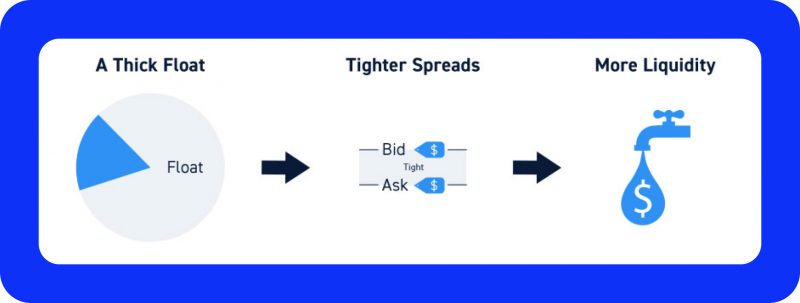

High-floating stocks usually have over 100-200 million shares that investors can buy in public markets. Huge corporations and multinational companies have high-float stocks because they issue more stocks and attract more investors to buy and help raise capital.

Apple, Amazon and Microsoft are popular public companies that have a huge number of outstanding stocks in secondary markets. They are less volatile because of their significant amount.

Medium-float stocks usually have between 50-100 million shares and offer balance characteristics of volatility, scarcity and valuation. Spotify, Dropbox and Roku are corporations with medium-floating stock.

These stocks fluctuate widely during economic announcements or news and can be volatile during liquidity changes.

Low-float stocks often have less than 10-20 million shares. Crocs, GoPro and Shake Shack are some of the best low-float stocks that offer huge gains with high volatility.

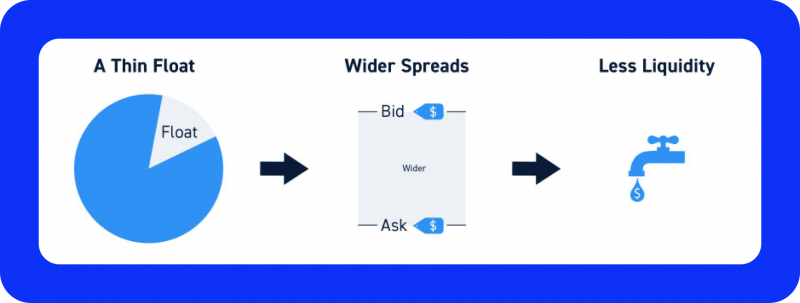

These equities massively fluctuate because they are less common, and many investors trade low-float penny stocks to minimise their initial investment loss. They have low liquidity levels, which makes it more difficult to find buyers/sellers for your trading order.

How to Find Low Float Stocks?

Locating these investing opportunities requires advanced market knowledge and comprehension of stock performance, newly issued equities and economic announcements. Here’s how you can start.

Stock Screeners

Stock screening websites, like the Finviz platform or FintechZoom, provide insight into a broad range of investment opportunities in equities. Instead of scrolling through multiple securities and markets, low-float stocks screeners focus on in-depth analysis, predictions, expert advice, and trading strategies.

Brokerage Firms

Finding a reliable brokerage platform and receiving investment advice is the best way to step into the market and find the most lucrative opportunities. You can get an account manager or broker and track stocks with low float. Be aware of the brokerage’s charges in exchange for their services and scam websites claiming financial services.

Specialised Platforms

There are dedicated websites, like LowFloat.com and FloatChecker.com, that offer detailed information about stock floats and allow you to locate low-floating stock shares. This approach allows you to track changes in equities, monitor volatility and find new public companies.

Earnings Reports

A Company’s balance sheet and economic reports are announcements that affect low-floats, especially since they are scarce and fluctuate quite dramatically with market action. Stocks with limited available shares can be volatile a few days before these reports as traders speculate on their outcomes.

New IPOs

Companies filing for stock issuance and public offering often start with few shares in secondary markets. This limited float offers highly lucrative market opportunities, especially if the market has a high business potential. Keep your on new shares’ growth as this strategy is risky if the particular stock underperforms and your investment loses massively.

Advantages and Disadvantages

Trading stocks with a low float and high return potential can significantly boost your portfolio. However, their characteristics do not make them the ideal investment instruments. Let’s review their pros and cons.

Pros

- High gain potential because low-floats are rare to find, and the demand surpasses the supply.

- Their volatility makes them an excellent choice for day traders and short-term gains.

- Easy to speculate as economic news and events are the main drivers for their growth or devaluation.

Cons

- The high associated volatility can be risky as any price climbs can turn into steep drops depending on supply and demand changes.

- Highly speculative, and prices can move unexpectedly.

- Since there are fewer shareholders, liquidity issues persist, and traders find it difficult to execute their orders.

How to Trade These Stocks?

Low-float stocks can be risky, and only with a calculated approach can you succeed in the market. Here are the top three strategies.

Momentum Trading

Since lot-float shares fluctuate sharply due to limited liquidity, low supply and high demand, a stock’s price momentum usually has a sharp trajectory. Once you locate the start of a trend, you can capitalise on these moments and execute long or short positions to earn massively. Significant momentums often happen after economic news or crucial announcements.

Breakout Trading

When the market price breaks outside the resistance or support levels, these stocks can move consistently in the same direction. Therefore, locating and capitalising on breakouts is a lucrative strategy to trade low-float stocks and benefit from their characteristics. However, this approach requires close monitoring to predict and identify breakouts accurately.

Scalping

With the relatively high volatility of stocks with limited floats, short-term investment strategies can be lucrative. Scalping small profits on repeat can be successful, especially if the market experiences an uptick in volatility and demand.

Conclusion

Stock float is a term used to describe the number of shares available for public investments. The number of “floating” shares affects its stability, volatility and liquidity.

Therefore, low-float stocks offer high-return investing opportunities. However, you must carefully trade them because prices can change suddenly, and liquidity constraints can affect your profitability model.